Important points

- The S&P 500 fell 0.7% on Tuesday, April 2, 2024, amid growing concerns about the timing of a potential rate cut.

- Health care stocks fell after the federal government announced that Medicare Advantage payment rates would not increase as much as the industry expected.

- Oil prices rose on supply concerns, supporting gains in stocks of companies in the oil and gas sector.

Major US stock indexes fell as concerns grew that the US Federal Reserve (Fed) may cut interest rates in the near future.

Signs of continued economic strength cloud the picture as Fed officials consider the best time to adopt an accommodative policy stance.

The S&P 500 fell 0.7%, falling for a second straight day as stocks struggled to find their footing early in the second quarter. The Dow and Nasdaq fell about 1.0%.

Healthcare stocks rose after the Centers for Medicare and Medicaid Services (CMS) announced that Medicare Advantage plans would see a 3.7% annual price increase from 2024 to 2024, in line with the original plan announced in January. fell. This revision to payment amounts disappointed major medical insurance companies, which had been demanding larger increases in response to soaring medical costs, and more modest increases put pressure on profit margins.

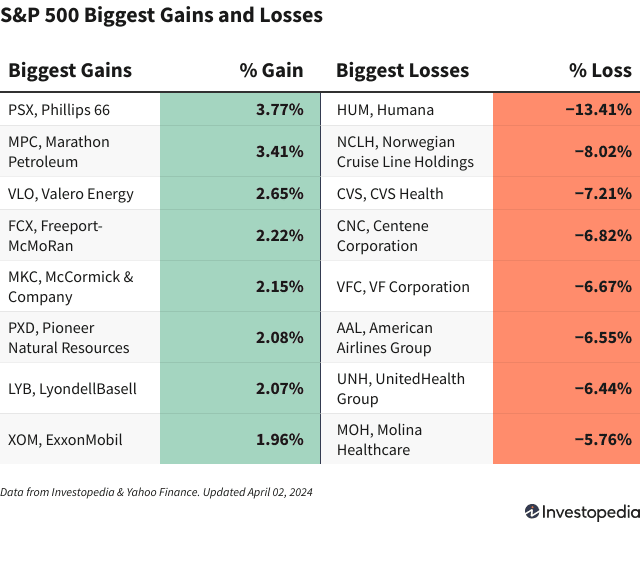

Shares of health insurance giant Humana (HUM) fell 13.4%, the biggest decline in the S&P 500 following the CMS announcement. The losses also affected other companies in the healthcare space, with shares of pharmacy giant CVS Health (CVS) falling 7.2% and shares of fellow insurance companies Centene (CNC) and UnitedHealth Group (UNH) falling respectively. It fell by 6.8% and 6.4%.

Norwegian Cruise Line (NCLH) shares are at 8.0 after reports that one of the company’s ships was stranded on the African island of Sao Tome and Principe with eight passengers who arrived late after a private trip. % fell. A company spokesperson said travelers are responsible for returning to the ship by the published boarding time.

Shares of VF Corporation (VFC), which owns clothing brands such as The North Face and Vans, fell after fellow apparel company PVH (PVH) said it expected to be adversely affected by difficult macroeconomic conditions in Europe. As a result, the stock fell by 6.7%. PVH stock plunged 22.2%.

Oil futures rose as tensions in the Middle East, drone attacks on Russian refineries and a possible extension of OPEC+ production cuts heightened supply concerns. Rising prices helped lift oil and gas stocks.

Phillips 66 (PSX) stock was the best performer among the S&P 500 stocks on Tuesday, rising 3.8%. Marathon Petroleum (MPC) and Valero Energy (VLO) shares rose 3.4% and 2.7%, respectively.

Oil wasn’t the only commodity whose prices soared. Copper prices also rose as China’s economic outlook improved. Shares of copper producer Freeport-McMoRan (FCX) rose 2.2% on the rise.

McCormick & Company (MCK) shares also rose 2.2% after Argus upgraded the stock to a “buy” rating. Analysts highlighted the potential to boost the spice company’s sales, which have been sluggish in some regions.