Dr. Jerome Adams, who served as Surgeon General from 2017 to 2021 under former President Donald Trump, recently published an article about an unexpected medical bill he received after visiting an emergency room in Arizona. Dr. Adams became dehydrated while hiking in January and was treated at a local emergency room with three bags of intravenous fluids, blood work and x-rays. Dr. Adams recovered and was released from the hospital.

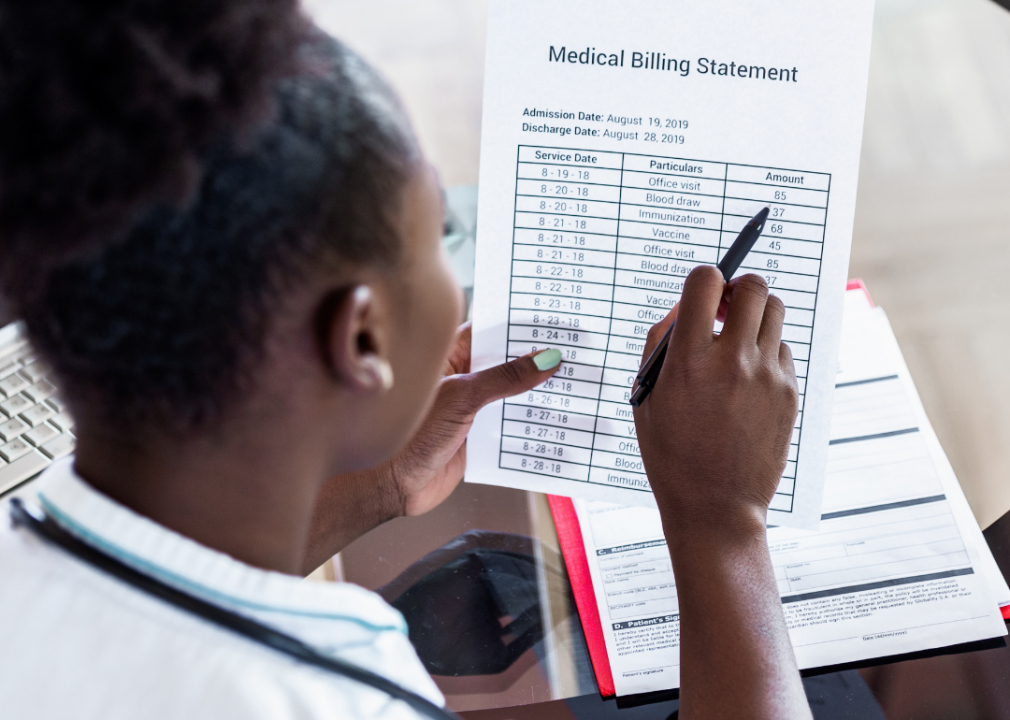

Six weeks later, Adams was billed for the visit for a total of $10,000, which his insurance company reduced to $4,800. He disputed the exorbitant charges, but the health system refused to reduce them, saying the fees were legal and consistent for all patients. Adams had a high-deductible health plan with a Health Savings Account (HSA), but because he had not contributed to his HSA earlier that year, he had to pay the full amount. It was an amount he could afford, but most people cannot.

Inflation is one of the major concerns facing voters in this fall’s election. Health care costs account for about 20% of GDP, and their rapidly rising costs are a major driver of inflation. Federal and state candidates from both parties should be asked to propose strategies to contain these costs.

Why are healthcare costs rising so rapidly? According to a recent series in the Wall Street Journal, healthcare consolidation and mergers are the main culprits. Despite promises of cost savings and maintaining quality, numerous academic studies have shown that increased healthcare consolidation leads to less competition and higher prices. Private equity firms and hospital systems have been aggressively acquiring physician practices over the past 20 years. Today, more than 75% of physicians are employed by large corporations or health systems. One example of how hospitals increase costs when they acquire physician practices is by charging additional “facility fees,” which can double a physician’s visit fee and add nothing to the value of the practice.

The Federal Trade Commission (FTC) has tried to stop some of the mergers and consolidations, but it is severely underfunded and understaffed. In the past 20 years, there have been more than 1,000 mergers among the nation’s 5,000 hospitals. More than 200 of these transactions should have been stopped due to monopoly concerns, but the FTC acted in only 13 cases.

Medical debt is a major cause of 66% of bankruptcies in the United States. Consumers shoulder more of their medical expenses because 60% of people with employer-sponsored health insurance choose high-deductible health plans with HSAs. This strategy allows consumers to enroll in health insurance through their employer or through the Affordable Care Act exchanges. The problem is, they may be hit with high medical bills until their high deductible is met.

Insisting on price transparency for healthcare costs helps promote competition and curb inflation in this sector of the economy. The Hospital Price Transparency Rule, enacted by presidential decree in 2021, requires hospitals to post their prices on their websites in a readable format. Unfortunately, only a third of hospitals are fully compliant, preferring to pay small fines to avoid posting high prices. Moreover, the prices posted are usually disguised in Excel spreadsheets of indecipherable billing codes.

Each of us can contribute to reducing the cost of healthcare by always inquiring about the cost of healthcare services before receiving them and making an informed decision about whether to receive healthcare services from that facility or not. Such inquiries require persistence. The real cost is intentionally hidden. We should purchase healthcare services just like we purchase everything else when we know the price of what we are buying.

Dr. Bob Newman is a clinical professor of family medicine at Eastern Virginia Medical School. He is the author of “Patient’s Compass,” a guide to understanding the U.S. healthcare system. If you would like a paper copy of the book, please email me at [email protected].