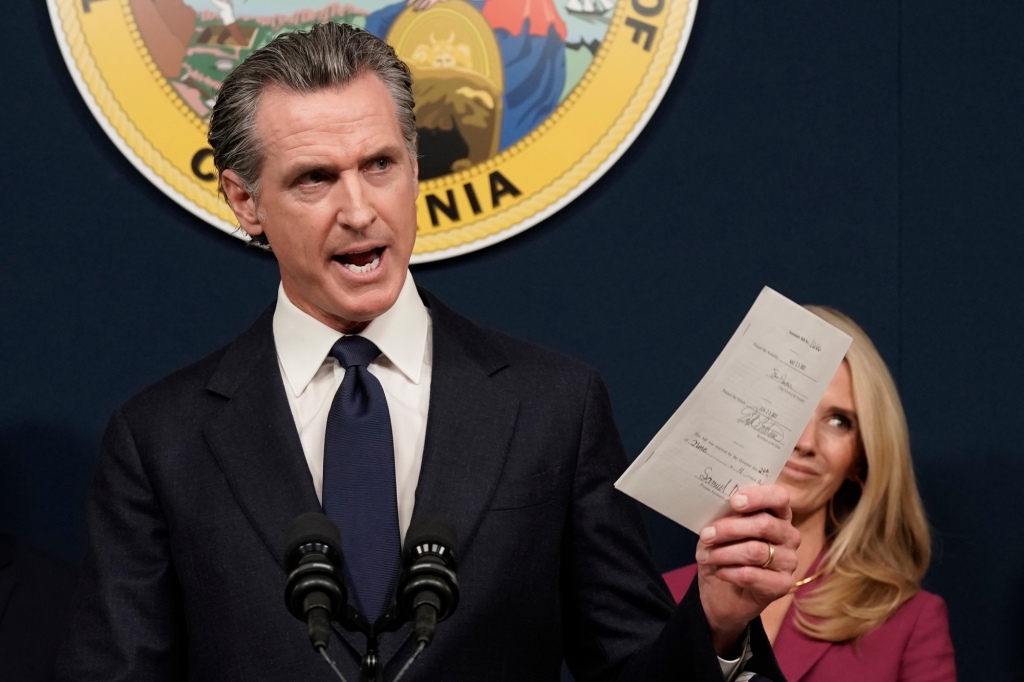

In a video shared on social media, Gov. Gavin Newsom told parents in the Temecula School District, “Children are free to learn, and you are free to access those books.” (Ricci Pedroncelli, Associated Press)

California’s uniquely high cost of living permeates every industry, and healthcare is no exception.Total Health Care Spending in California $405 billion By 2020, it will outpace overall US healthcare spending on an average annual basis.

Almost 40% of Americans The cost is delaying me from going to the doctor and getting the treatment I need. This is unacceptable. To make matters worse, when Californians try to save money on health care, the state imposes taxes on them.

Many Americans open a Health Savings Account (HSA) to save on current and future health care costs, such as medical, dental, vision, and prescription costs. Nationwide, he has over 35 million of his HSA accounts, and is expected to approach 43 million by 2025 in the United States. More than half of individuals with HSA live in a zip code where her median annual income is less than $75,000. In California, more than 5 million of her, including dependents, are covered by her HSA. Families and individuals appreciate the HSA’s ability to decide when and how they spend their medical expenses, and the ability for employers to help pay deductibles, copays and coinsurance.

In most parts of the country, HSAs are tax exempt and are not subject to federal income tax. However, California will tax her HSA contributions and will also tax employers who contribute to her HSA of their employees. Workers who keep money in these accounts to lower their monthly premiums or pay out-of-pocket medical costs, as well as employers who choose to contribute to their employees’ HSAs, are taxed to help cover these necessary medical costs.

An example is shown below. Angela is a California employee with family insurance through consumer health insurance. She donates her $3,000 to HSA through her paycheck and her employer contributes her $1,000 to HSA. From a federal income tax perspective, Angela and her employer’s HSA contributions are pre-tax and tax-free. In California, Angela’s contributions to her HSA are reported as taxable income, with increased state taxes, and her employer’s contributions to her HSA are treated as after-tax contributions.

This is a direct attack on low- and middle-income households by states that intend to tax hardworking citizens in every possible way. This tax on medical savings is so unusual that New Jersey is the only state besides California to punish her HSA-dependent family in this way.