Are New Yorkers paying more under the Affordable Care Act than people elsewhere?

Open enrollment begins in just over two months, and if you don’t have health insurance, you can visit New York’s Affordable Care Act portal to choose a plan.

An interesting question came from a viewer about how New York’s program compares to programs in other states.

Lisa wrote, “Obamacare was supposed to make health insurance affordable. We pay about $900 a month in premiums for myself and over $900 a month for my husband…. We just met with a family in Pennsylvania who appears to be on the same plan (just with a different name) and are each paying less than $200 a month.”

Lisa wants to know whether Affordable Care Act insurance programs are actually more affordable in other states. That’s a great question.

First, let me provide a little background: The Affordable Care Act is now federal law. It requires every state to have a health insurance marketplace where insurance companies cannot discriminate or charge women more than men because of pre-existing conditions.

States can choose to run their own marketplaces, partner with the federal government, or have the federal government run their state’s marketplaces. And, yes, the amount you pay for insurance will depend, to some extent, on which state you live in.

Thorough study A study by the Urban Institute found that states that operate their own marketplaces have lower premiums because more insurers participate, and competition drives down premiums.

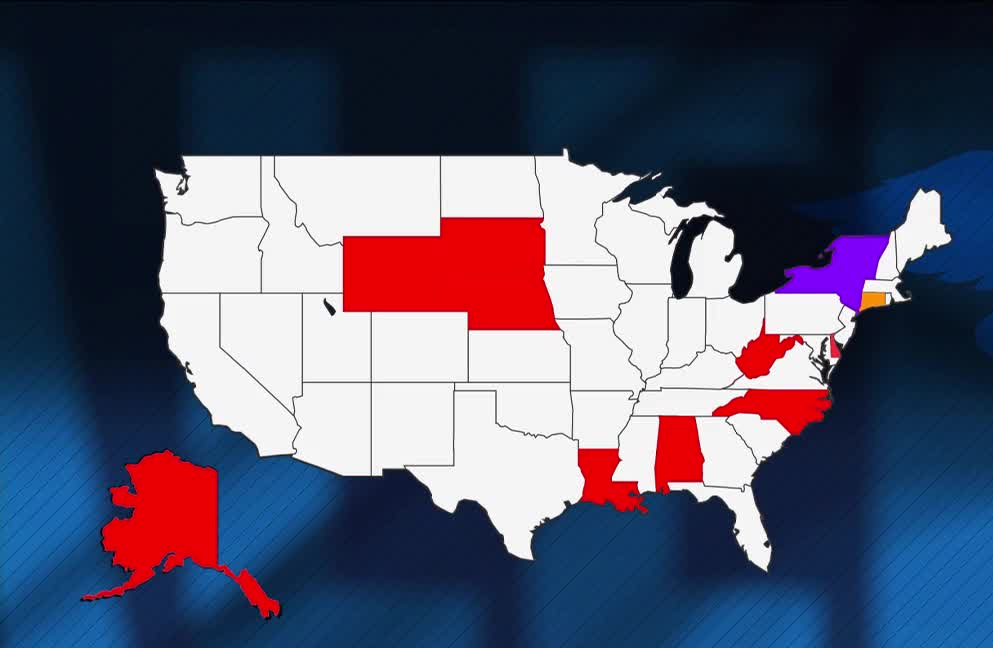

The institute analyzed average state premiums for a 40-year-old nonsmoker and found that only 12 states have average premiums above $500: Alabama, Alaska, Connecticut, Delaware, Louisiana, Nebraska, New York, North Carolina, South Dakota, Vermont, West Virginia, and Wyoming. Nine of the 12 states do not have a state-run marketplace, which predictably leads to higher premiums.

However, Connecticut, New York, and Vermont all have some of the highest health insurance premiums in the country, despite being state-run markets. Let’s leave out Connecticut, because it’s the exception. But New York and Vermont have something in common: they both have local rating mandates for health insurance, which means insurers are not allowed to base premiums on age, smoking, sex, health status, or pre-existing conditions. Premiums are determined based on the average costs for all insured people, based on local medical and hospital costs, not on individual risk factors.

The reason for community pricing is to ensure that we all pay the same amount, and that no one is charged a higher price because of personal risk factors such as age. But critics say community pricing could have unintended consequences, ultimately raising prices for everyone as younger, healthier people choose not to buy insurance.

New York’s average premium for a 40-year-old non-smoker is $621, the sixth-highest in the country, while Vermont has the fourth-highest at $738.

Income also influences the price of premiums, as premiums for low-income individuals are subsidized.

Lisa, here’s the long answer to your question: Yes, the amount of tax you pay will increase depending on where you live and how much you earn.

If you have a consumer research idea, please email us at [email protected]Om.