Uninsured rates have fallen to historically low levels, but health care costs remain a significant financial burden for many who cannot afford the coverage they have, according to a national health survey. became clear in

About 43% of working-age adults will be “underinsured” in 2022, according to a new study from the Commonwealth Fund. Health policy non-profit organization.

” read more: Inflation hits Pennsylvania’s ACA health plan

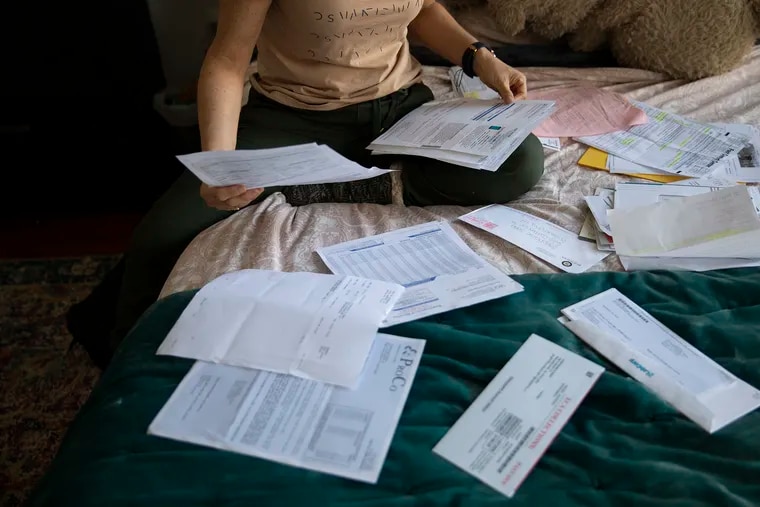

People struggling to pay for medical bills were regularly delaying needed appointments, skipping prescribed medications, and piling up medical bills they couldn’t repay.

“Having health insurance is not enough,” said Sarah Collins, vice president of the Federal Foundation and lead author of the study, in a statement.

The biennial survey included a nationally representative sample of 8,022 adults contacted online or by phone between late March and early July.

Paying medical bills is most difficult for people without insurance to help offset the costs.The national uninsured rate is record low By early 2022, about 8% of Americans had no insurance.Pennsylvania and New Jersey slightly better fareAccording to the Kaiser Family Foundation, the uninsured rate will be 5.9% and 5.4% respectively in 2021, the latest year for which local data is available.

But Commonwealth Foundation research also shows that the majority of people with health insurance cannot afford the care they need.

Just under 30% of people with health insurance from their employer and another 44% with coverage from the private market were underinsured in 2022. They couldn’t afford to ask for care.

” read more: Bundles of joy, piles of bills: Giving birth can cost thousands of dollars

High deductibles, high premiums, and skyrocketing health care costs eroded people’s ability to stay healthy.

-

49% of survey respondents said they could not afford an unexpected $1,000 medical bill. (The average deductible for individuals covered by the 2021 Employer Plan was $1,434 for him.)

-

46% skipped or delayed treatment because of cost.

-

42% were struggling to pay their medical debt.

Those who didn’t put off treatment without money often faced a difficult decision later on how to pay off their debts. Survey respondents said they depleted their savings, opened new credit cards, and put off career and education plans to pay for medical bills. A little over 1 in 4 said they couldn’t afford essentials like food, heat, and rent because of medical debt.

“The fact that so many people in this country cannot afford the health care they need shows the importance of addressing the cost of health care, even with record coverage. ‘ said the organization’s president, David Blumenthal, in a statement.

” read more: What you need to know about the impact of medical debt on your credit rating