Mental health problems are getting worse in the United States. According to the National Institute of Mental Health (NIMH), about 20% of adults, or 43 million of her, suffer from some form of mental illness each year. The conditions range from mild conditions such as depression and anxiety to more severe conditions such as dementia, bipolar disorder and schizophrenia. Below are three pioneering biotech stocks with unique products to address the needs of mental illness.

ATAI Life Science

When you think of drugs like ketamine and psilocybin, you probably think of hippies and Woodstock, not medical. ATAI Life Science ATAI I’m trying to turn that story upside down. The Germany-based company, which made his IPO in mid-2021, was founded by Florian Brando, a serial tech entrepreneur who struggled with mental health issues early in his life before overcoming them. was established. After watching his close friends struggle with mental health issues before successfully self-medicating with psychedelics, Brand realized patients around the world were undertreated.

science

According to ATAI’s website, the company’s mission is to “pioneer the development of highly effective mental health treatments that address the unmet needs of patients.” ATAI’s pipeline includes drugs to treat anxiety, depression, schizophrenia, substance use disorders, and traumatic brain injury. Psilocybin (a hallucinogenic compound found in “magic mushrooms”) and ketamine (a powerful anesthetic and analgesic) are both used recreationally. But ATAI Life Sciences is undertaking research into these and other drugs for their potential to treat mental health problems. Proponents of the treatment suggest it has a positive impact on mood, emotional processing, and overall brain health.

Investor outlook

The treatment for ATAI is in the clinical research stage, and without dramatic changes, it is premature to invest in ATAI life sciences beyond speculative bets.

Image Source: Sachs Investment Research

Photo: ATAI’s next 12-month EPS forecast (green line) overlaid on price chart. ATAI is expected to be unprofitable over the next 12 months.

Like other biotech companies in clinical trials, ATAI has yet to make an annual profit. Still, ATAI is worth watching from afar. If a company can successfully demonstrate the benefits of treating mental disorders, the rewards are plentiful. ATAI includes legendary Silicon Valley investor Peter his teal and popular portfolio his manager Kathy Wood. ARK Innovation ETF ARK, Other publicly traded companies looking to roll out similar treatments include: Cybin CYBN, Compass Pathways CMPS, Seelos Therapeutics SEEL, When Mind Medicine MNMD.

Biogen K.K.

In contrast to most biotech stocks, Biogen Inc. BIIB It has a profitable and deeply established drug pipeline. Founded in 1978 by several leading biologists, the company has provided treatments and solutions to some of humanity’s greatest health problems, including neurological disorders, autoimmune disorders and cancer. Perhaps this is why Biogen is working to provide a solution for Alzheimer’s disease.

Giving Alzheimer’s patients a glimmer of hope

Alzheimer’s disease is a progressive, irreversible disorder that affects the brain’s ability to function properly. There is currently no cure, and as the disease worsens, patients face a debilitating experience of slowly losing memory and the ability to think in real time. Little progress was made despite the time and effort put into it.

Biogen and Japanese partners in the project Eisai ESALY A glimmer of hope was offered in September when the company announced that disease progression was significantly slowed in patients taking the drug Lecanemab. Biogen is currently awaiting Fast Track approval results, which will be announced in the first few months of 2023.

Investor outlook

Biogen’s basic framework creates a sticky situation for investors. Although the company is highly profitable, sales and profit growth have come to a screeching halt in recent quarters as royalties for its multiple sclerosis and other existing drugs dwindled. , the focus is on lecanemab and its future. When news broke in September that lecanemab slowed the progression of Alzheimer’s disease in a study group, Biogen’s stock rose 40% in volume and outperformed his average by 1255% –

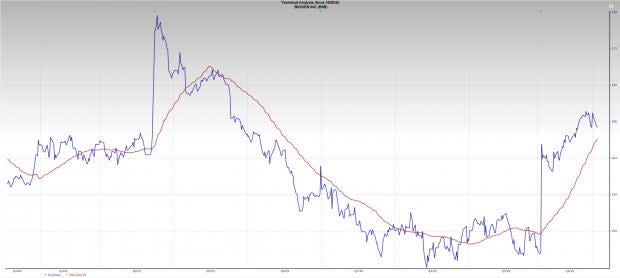

Image Source: Sachs Investment Research

Photo: BIIB jumped 40% in September after releasing positive drug data. The stock is looking for support at the 50-day moving average (red line).

Biogen is currently on an uptrend and is supported at the 50-day moving average. If the company can get speedy FDA approval for its drug, the stock should continue to rise. As with any biotech stock, investors should be aware of their own risks. FDA’s decision leads to two-way risk. When binary risk goes against you, the consequences can be devastating.

Sage Therapeutics

Sage Therapeutics Inc SAGE is a biopharmaceutical company developing new treatments for brain health disorders such as postpartum depression (PPD) and major depressive disorder. Many antidepressant treatments now exist, but none specifically target his PPD.

Helping New Mothers Overcome Postpartum Depression

Postpartum depression is common among new mothers. Rapid hormonal fluctuations during and after pregnancy put mothers at risk for psychiatric disorders. PPD can lead to strong feelings of inadequacy, anxiety, sadness, and fatigue. In partnership with Biogen, Sage is working on a developmental drug known as Zranolone to treat her PPD. If approved, the drug would be the first to treat her PPD.

Investor outlook

Like Biogen and ATAI, Sage’s outlook is highly dependent on future data decisions. The company is not yet profitable, but its partnership with industry leader Biogen ensures that it is in a stable financial position.

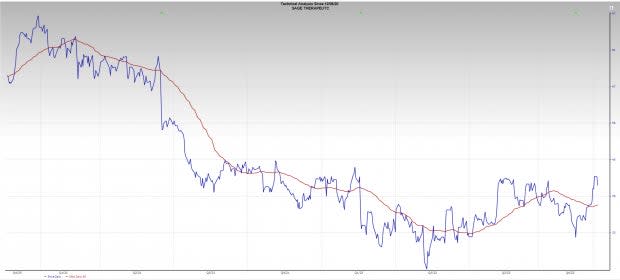

Image Source: Sachs Investment Research

Photo: SAGE recently broke above the 200-day moving average.

Stocks rebounded to the 200-day simple moving average in November. This is the level many investors use to determine long-term stock price trends. In a recent statement, Sage said: We believe that if zranolone is approved, it will change the way depression is treated. “

Want the latest recommendations from Zacks Investment Research? Download today the 7 Best Stocks of the Next 30 Days. Click to get this free report

Biogen Inc. (BIIB): Free Stock Analysis Report

Eisai Co., Ltd. (ESALY) : Free Stock Analysis Report

atai Life Sciences NV (ATAI) : Free Stock Analysis Report

Sage Therapeutics, Inc. (SAGE) : Free Inventory Analysis Report

ARK Innovation ETF (ARKK): ETF Research Report

Seelos Therapeutics, Inc. (SEEL) : Free Stock Analysis Report

COMPASS Pathways PLC Sponsored ADR (CMPS) : Free Inventory Analysis Report

Mind Medicine MindMed Inc. (MNMD): Free Stock Analysis Report

Cybin Inc. (CYBN) : Free Inventory Analysis Report